The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

You have actually possibly come across the term exclusive equity (PE): spending in business that are not publicly traded. Roughly $11. 7 trillion in possessions were taken care of by personal markets in 2022. PE companies seek possibilities to gain returns that are far better than what can be achieved in public equity markets. There might be a few points you do not recognize about the sector.

Private equity companies have a variety of investment preferences.

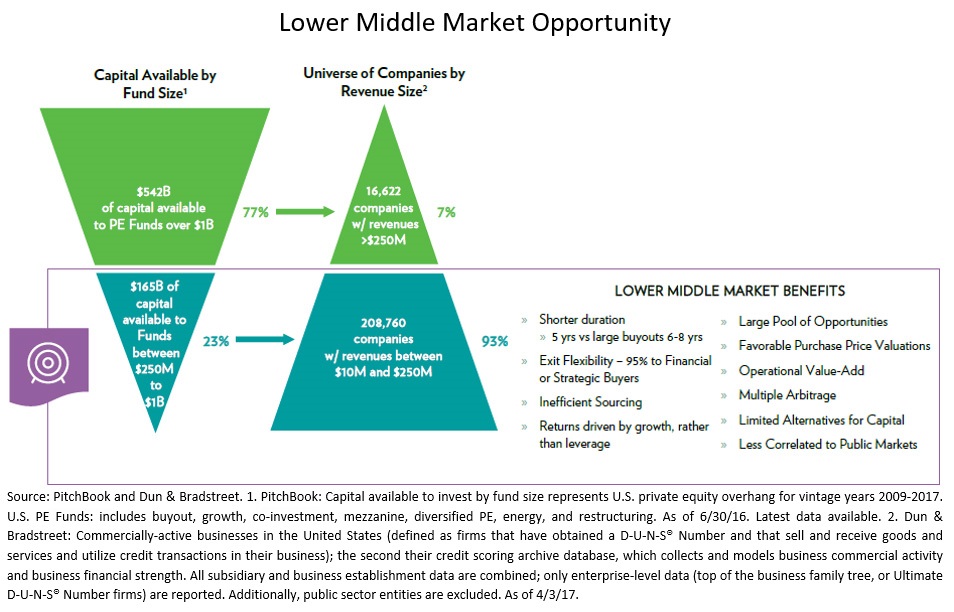

Due to the fact that the finest gravitate toward the larger offers, the center market is a dramatically underserved market. There are more sellers than there are highly seasoned and well-positioned money professionals with considerable purchaser networks and resources to take care of an offer. The returns of private equity are generally seen after a few years.

9 Simple Techniques For Custom Private Equity Asset Managers

Flying below the radar of large international corporations, a lot of these small firms often you can try this out provide higher-quality customer support and/or specific niche services and products that are not being supplied by the huge empires (http://ttlink.com/cpequityamtx). Such benefits bring in the passion of personal equity companies, as they possess the understandings and savvy to exploit such opportunities and take the business to the next level

A lot of managers at portfolio business are provided equity and bonus compensation frameworks that award them for striking their financial targets. Private equity chances are commonly out of reach for people that can't spend millions of dollars, yet they should not be.

There are policies, such as restrictions on the accumulation quantity of money and on the variety of non-accredited investors. The private equity organization draws in some of the very best and brightest in business America, consisting of leading performers from Lot of money 500 business and elite monitoring consulting firms. Law office can likewise be hiring grounds for private equity hires, as accounting and lawful skills are essential to total offers, and deals are highly searched for. https://wh8yd8agf3f.typeform.com/to/bDcW2xON.

Custom Private Equity Asset Managers Things To Know Before You Get This

One more disadvantage is the absence of liquidity; as soon as in a personal equity transaction, it is difficult to leave or sell. There is an absence of adaptability. Exclusive equity also includes high costs. With funds under administration currently in the trillions, exclusive equity companies have come to be attractive financial investment vehicles for wealthy people and institutions.

Now that accessibility to private equity is opening up to more specific capitalists, the untapped potential is ending up being a fact. We'll begin with the major arguments for spending in private equity: Just how and why private equity returns have actually historically been greater than other properties on a number of degrees, How including personal equity in a portfolio impacts the risk-return account, by assisting to diversify versus market and cyclical threat, After that, we will certainly outline some crucial factors to consider and threats for exclusive equity financiers.

When it comes to presenting a new property into a portfolio, the a lot of basic factor to consider is the risk-return profile of that property. Historically, private equity has actually exhibited returns comparable to that of Emerging Market Equities and higher than all other standard property courses. Its reasonably reduced volatility paired with its high returns produces an engaging risk-return account.

6 Easy Facts About Custom Private Equity Asset Managers Described

Private equity fund quartiles have the largest range of returns across all alternative asset classes - as you can see listed below. Methodology: Inner rate of return (IRR) spreads out calculated for funds within classic years individually and after that averaged out. Typical IRR was computed bytaking the standard of the typical IRR for funds within each vintage year.

The takeaway is that fund selection is critical. At Moonfare, we perform a rigid option and due diligence process for all funds provided on the system. The result of adding personal equity into a profile is - as constantly - based on the portfolio itself. A Pantheon research from 2015 suggested that consisting of personal equity in a profile of pure public equity can open 3.

On the other hand, the finest exclusive equity companies have accessibility to an also bigger pool of unknown opportunities that do not deal with the same examination, in addition to the sources to execute due diligence on them and recognize which are worth investing in (Asset Management Group in Texas). Spending at the first stage implies higher danger, but also for the business that do succeed, the fund benefits from greater returns

Our Custom Private Equity Asset Managers Ideas

Both public and private equity fund managers commit to spending a portion of the fund yet there remains a well-trodden problem with aligning rate of interests for public equity fund monitoring: the 'principal-agent issue'. When a financier (the 'major') works with a public fund manager to take control of their funding (as an 'representative') they entrust control to the manager while retaining ownership of the possessions.

When it comes to personal equity, the General Partner does not simply gain a management charge. They also earn a portion of the fund's profits in the form of "carry" (generally 20%). This makes certain that the rate of interests of the manager are aligned with those of the capitalists. Personal equity funds likewise minimize an additional type of principal-agent problem.

A public equity investor inevitably desires something - for the monitoring to enhance the supply cost and/or pay dividends. The financier has little to no control over the decision. We revealed over exactly how many private equity techniques - specifically bulk buyouts - take control of the running of the business, making certain that the lasting worth of the business precedes, pushing up the return on financial investment over the life of the fund.